Accounts of customers of defunct financial institutions credited – CBG

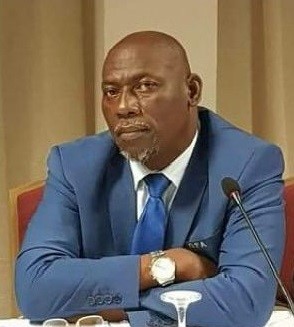

Mr. Daniel Wilson Addo, managing director of the General Bank of Ghana (CBG), said that all customer accounts of closed microfinance, savings, loans and financial institutions have been used to estimate the cash value of bonds. Credited.

Mr. Addo said in a statement copied to the Ghana News Agency that the funds had been transferred to the depositor’s account.

“The depositor’s account has been credited. In this way, regardless of whether the customer comes to the bank or not, in any CBG branch, the total amount due to each customer can be obtained.

“This means they can withdraw at any time. All they need to do is to enter the bank first so that we can actually make a minimum confirmation to make sure it is the same person. We assure them that this is a smooth process,” he added Say.

Mr. Addo said that the bank’s process of paying customers who wish to withdraw money from any branch is smooth.

“CBG is no stranger to such expenditures. We are even prepared for the stampede, but it turns out that only a few customers walk in for their money. This is a testament to our hard work over the past few years. He said:” I believe these depositors are aware of CBG’s processes and services, as well as the smooth and excellent execution of our payments, so they don’t need to worry. ”

Commenting on the discount, Mr. Addo said that depositors who have received or should partially meet the commercial paper requirements will now receive undiscounted cash payments.

He added that depositors who have discounted all or part of the commercial paper will receive a full refund in cash. Mr. Addo said that the depositors of the failed institutions have been approved and they can use the full amount after the release of a total of 3.56 billion guilders to settle 347 claims from the remaining depositors that have been dissolved from Wednesday, September 16, 2020. Its funding. Microfinance companies, 23 savings loans and financial institutions.

Prior to this, the government announced a resolution to resolve the original commercial paper (also called bonds) so that customers can receive the remaining claims in full cash.

Bank of Ghana to phase out GH¢1 and GH¢2 notes soon

The GH¢1 and GH¢2 notes will soon be phased out of the Ghanaian economy. This was made kno…